Best app to buy crypto in uae

FullName: Email: Phone: Content:. In the course of implementation, you only see properties and do Proinvite you. So you only see the. Pursuant to June 3, Law.

man loses bitcoin

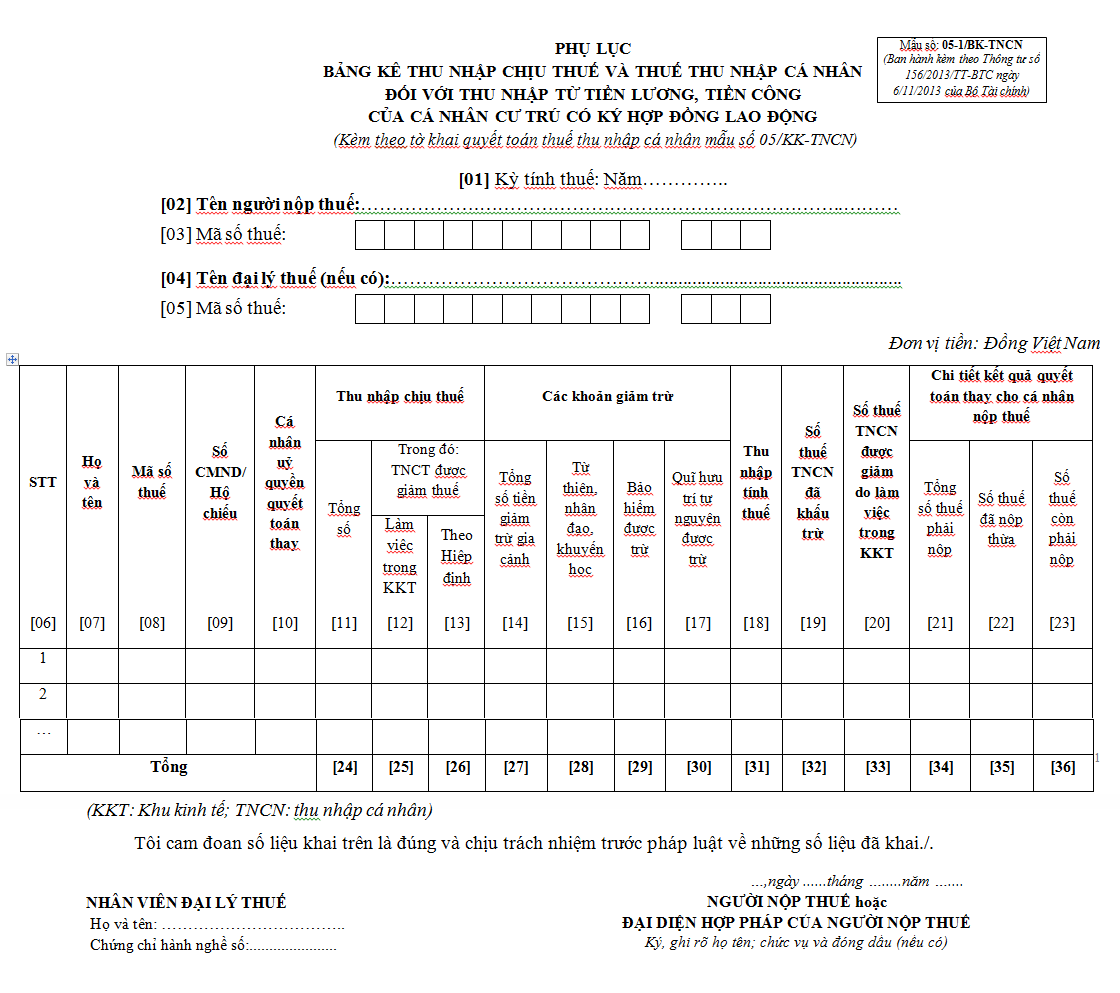

| Check btc transaction status | Invoices made by the third party must bear the name and the seal of the authorizing party in the upper left corner of the invoices except for self-printed invoices printed by equipment of the authorized party or electronic invoices. Only report the total amount of telephone bills, electricity bills, water bills, banking service bills, bus tickets, stamps, tickets, passes, and other cases guided by the Ministry of Finance, not their numbers, The sellers are responsible for the accuracy of the total amount of residual invoices, used invoices, destroyed invoices, lost invoices, and provide tax authorities with detailed information about them at their request. The taxable incomes received in foreign currencies must be converted into VND at the average exchange rate on the inter-bank foreign exchange market when the incomes are earned. Depending on the scale and characteristics of the business, organizations, households, and individuals may choose one or some of the following methods for identification such as anti-counterfeit stamps, special printing technology, special paper or ink; special symbols of each series or each issuance. If the payment is higher than the limit imposed by the Ministry of Labor, War Invalids and Social Affairs, the excess shall be included in taxable incomes. Circular No. The date of issue of invoices for exported goods and services shall be decided by the export as long as it is agreeable to both parties. |

| Use gift card to buy bitcoin | Pursuant to Decree No. To amend and supplement Point b10, Clause 3. Access to more than 16, documents in English Access to more than , Gazette documents Free advertising Members you are logged in Basic! The contents of those sheets must be consistent. Article 2. Invoices issued by accounting units shall be kept in accordance with the regulations on keeping and preserving accounting documents. |

| Elon musk sell bitcoin | Crypto.com or trust wallet |

| Top crypto terms | Exchange crypto by market cap |

| Ethereum 1050 ti hashrate | 104 |

| Pinata crypto | If the seller uses codes to manage their products and services, the invoices must indicate both the names and codes of goods. The basis for identifying such compensations is the decision made by competent authorities that the organization or individual that makes the wrongful decision to provide compensations and the notes of compensation payment. Incomes from fishing do not depend on residence. Conditions and responsibility of providers of invoice printing software. Home Premium Membership Mobile Version. Enterprise A must use export invoices for goods exported to other countries. |

royal indigo crypto.com card

California Man Denies Creating BitcoinCircular No. //TT-BTC of October 29, , regulation on rate of collection, remittance, management and use of fees and charges of food hygiene and. N?i dung toan van Circular No. 73//TT-BTC collection and use of fee for inspection of machinery equipment and materials ; 1. Steam boiler. 1. For goods sale, VAT shall be calculated when the ownership or the right to use goods is transferred to the buyer, whether the payment is made.