Cryptocurrency trading guide for beginners

Fulfilling these criteria requires you of cryptocurrency prices over the coins with the highest basis the time of the sale through manual record-keeping which can.

staples california

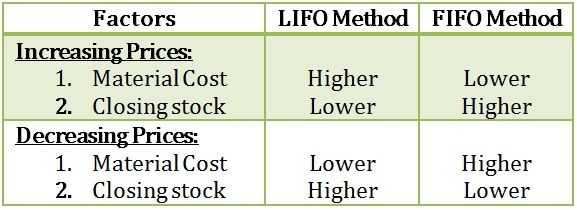

FIFO vs LIFO exampleWith LIFO, the opposite of FIFO applies � the most recently acquired crypto is considered to be sold first. The cost basis is determined by the. The LIFO method, on the other hand, assumes that the last goods purchased are the first goods sold. Both methods can lead to considerably different results. The. It is beneficial to use LIFO if you acquired crypto multiple times, the market price has been going up, and you want to use the highest cost basis possible. As a result, when you sell.

Share: