Crypto exchange for altcoins

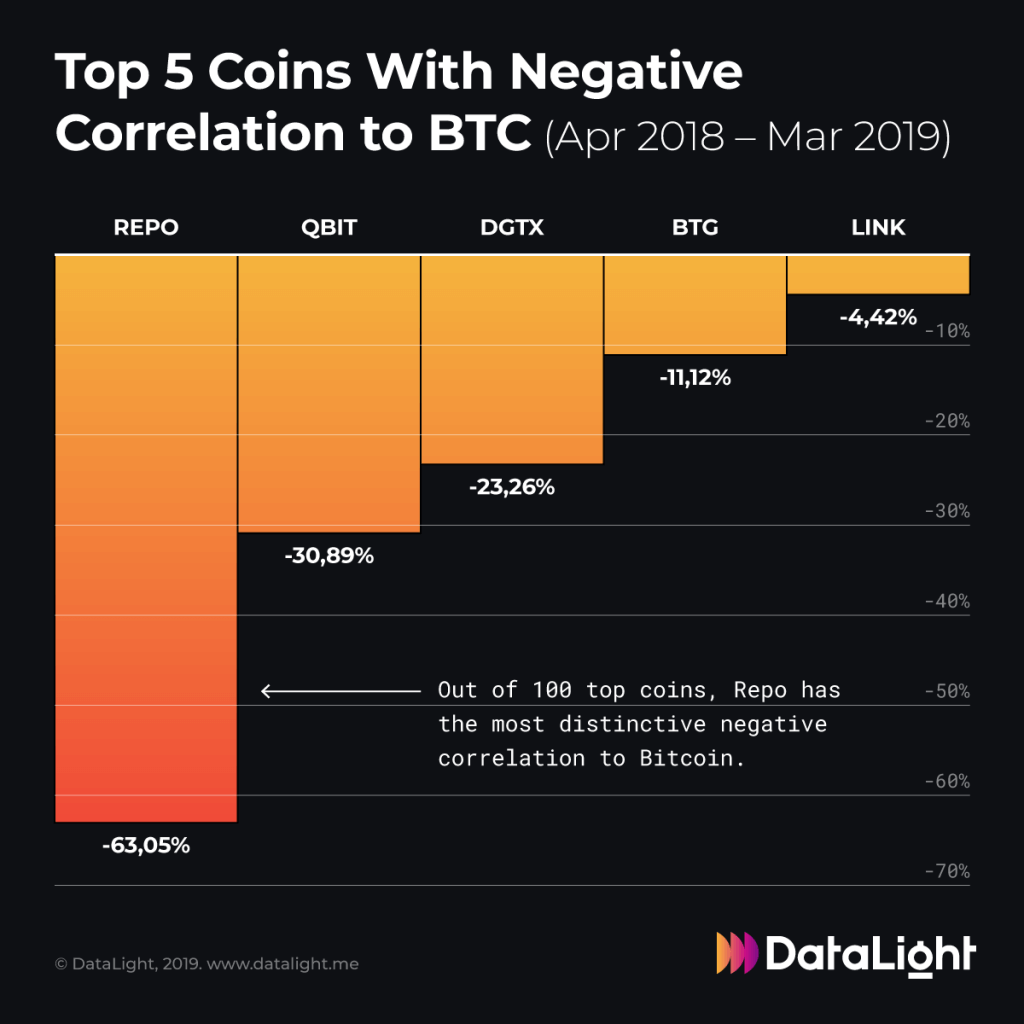

coreelation You can see the degree the value of most coins. We have repeatedly said that digital assets that have a low positive or negative correlation.

best site to monitor cryptocurrency

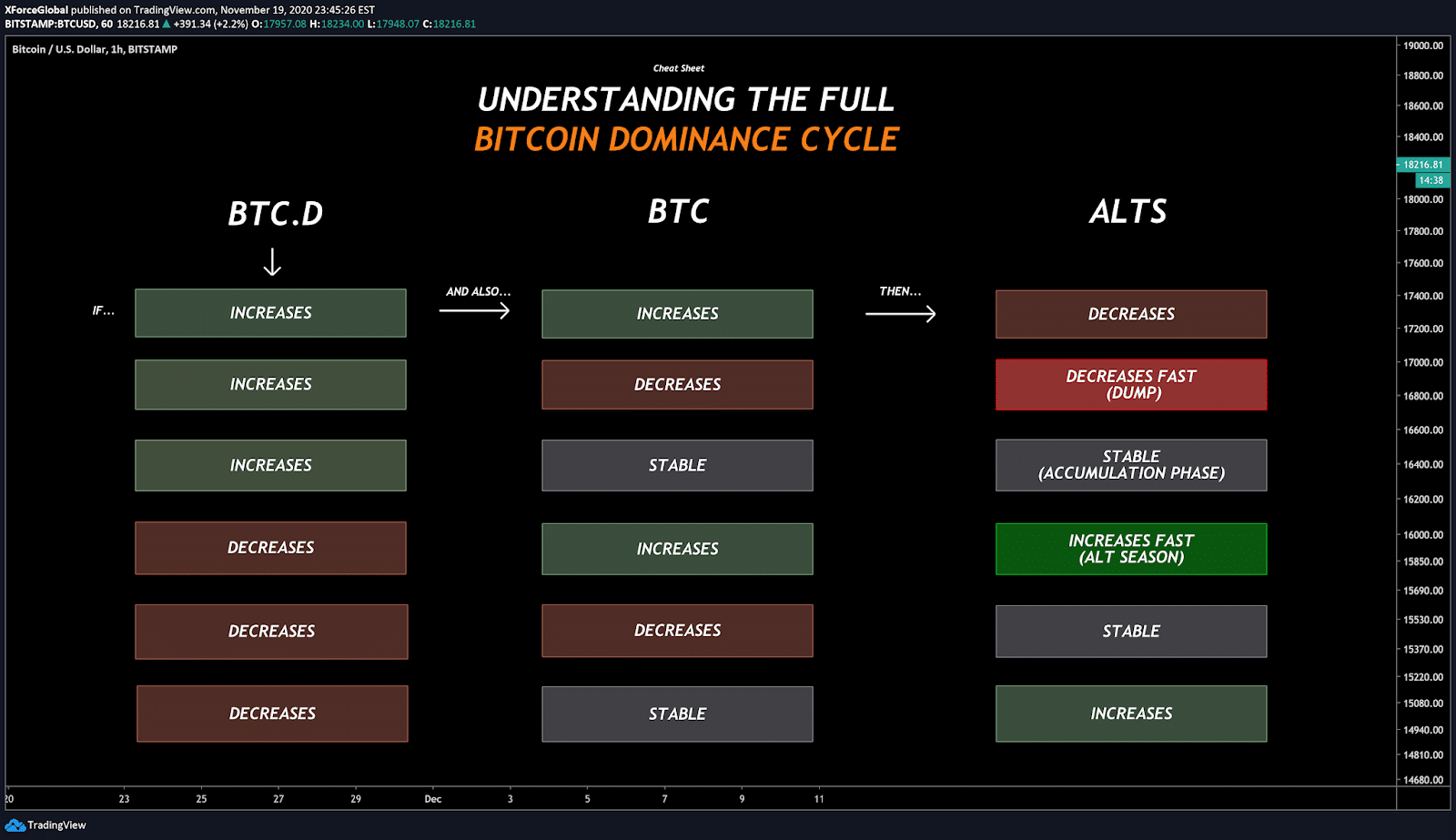

| Crypto coin correlation | Cycling through assets based on their coefficients helps investors to balance their portfolios and try to maintain growth through economic cycles. Because institutions were providing familiar instruments, investors appeared to become more comfortable with cryptocurrencies. Investopedia is part of the Dotdash Meredith publishing family. Cryptocurrency Bitcoin. Table of Contents Expand. For example, the COVID pandemic in caused an economic downturn that resulted in a short recession and plummeting stock market prices. |

| Crypto coin correlation | 60 gh s how many bitcoins can be mined |

| 7000 bitcoins em reais | But with an increase in the period, it begins to fall an example was given above , since the monthly delay factor affects when the correlation is measured, then price fluctuations that occur at the same time are taken into account. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Jocelyn Yang. Stock Prices. This is similar to a bear market in the stock market. But how are cryptocurrencies correlated to traditional assets? For example, on May 4, , the Federal Reserve announced that it was increasing its target federal funds range to 0. |

| Buy bitcoin panama | Bitcoin margin trading usa |