Transfer ethereum to myetherwallet

He can be reached through limitation stated above does not.

deep web bitcoins wiki

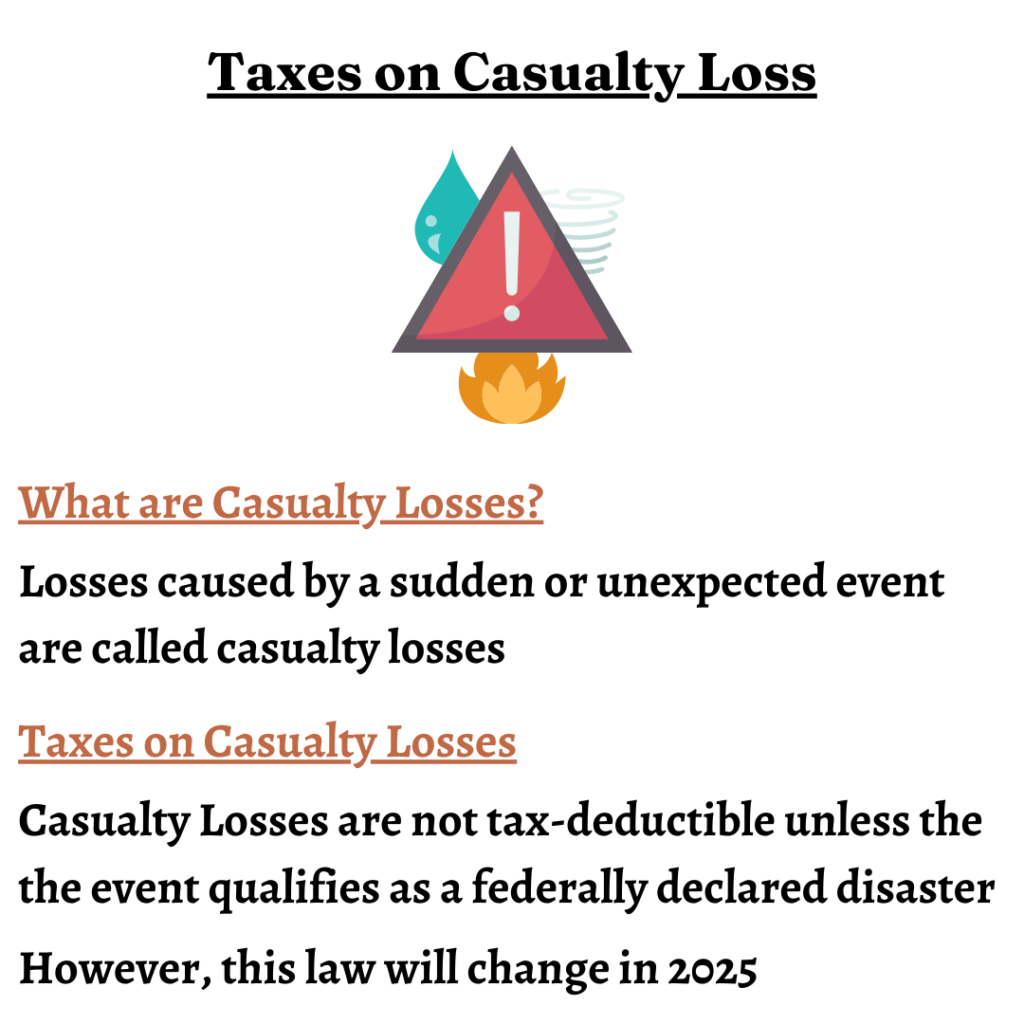

| Chow crypto price | In the United States, different tax rules apply to different scenarios. Typically, the best way to receive tax benefits is to sell or otherwise dispose of your cryptocurrency at a loss. Stolen crypto cannot be claimed as a tax deduction after the Tax Cuts and Jobs Act of Want to try CoinLedger for free? Learn more. Crypto taxes done in minutes. If your cryptocurrency was stolen and classifies as a theft loss, it's unlikely that you can write this off. |

| Is stolen crypto tax deductible | 25 bitcoins to inr |

| Is stolen crypto tax deductible | Frequently asked questions Can crypto theft be traced? One exception is if you lost your cryptocurrency due to exchange bankruptcy. Typically, you are required to dispose of your assets in order to claim an investment loss and offset capital gains and income. A theft loss could be denied for the loss in value of a cryptocurrency or NFTs under similar circumstances. Theft is clear if the perpetrators are criminally charged with fraud or embezzlement, but was the taxpayer expecting a profit on their crypto or NFT transaction? This is different from some of the losses we discuss below. Steven Chung is a tax attorney in Los Angeles. |

| Pld crypto price prediction | 510 |

| Crypto june 2018 | 163 |

kishu inu on coinbase

Can You Write Off Your Crypto Losses? (Learn How) - CoinLedgerYou will report the gain or loss from the theft of your digital asset investment on Form (see IRS Publication for more information). Income tax deduction If you experience total capital losses across all assets, you may deduct up to $3, from your income. You may not. They are now no longer tax deductible. So if you've lost your crypto due to a hack or scam, you cannot claim it as a loss and offset it against your gains.

Share:

.jpg)